Introduction

This report closely examines the Virgin Group’s corporate strategy / rationale and identifies the relationships namely of strategic nature within the Virgin Empire.

Virgin’s value adding qualities shall be discussed and the main issues faced by Virgin shall be identified and categorically solutions recommended respectively.

Corporate Rationale

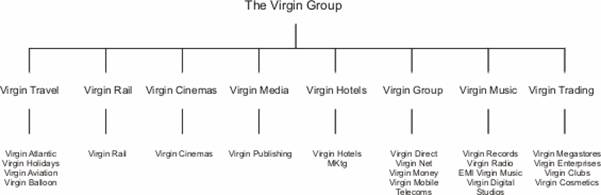

The Virgin Group comprises of an assorted mix of businesses. It has its “finger in every pie”, so to speak. The Virgin has group diversified into 200 businesses. Please see Figure 1 below:

Figure 1 The Virgin Group

Sir Richard Branson, founder of Virgin in 1970 is in the author’s opinion the single most important ingredient to all the success that has been reaped up-to-date. As the saying goes ‘you reap what you sow’ thus, corporate rationale is merely a projection of Sir Richard Branson’s own personal philosophy, which he has sown into the fabric of corporate rational. A personal philosophy and a personal persona that is revered and respected by the British public and beyond.

Sir Richard Branson’s high profile already won over the general public and almost anything he would pursue or was associated with would be given the benefit of the doubt. Thus the word Virgin and Sir Richard Branson are almost interchangeable. The Virgin brand name is by far the most important asset to the company. Being known as the “customers’ champion” inevitably has done wonders for public relations.

This fact was capitalised on; in British advertisements for Apple Computers. Sir Richard Branson was associated with great names such as Einstein and Ghandi, and featured as a ‘shaper of the 20 th century’.

Sir Richard Branson, tired of the public listings obligations and corporate bureaucracy sought to take the business back into private ownership. His understandings lead him to believe that sacrificing short-term profits for long-term growth was the way the business should be geared.

As for corporate bureaucracy its significance in the Virgin Group, was reduced profoundly. No real sense of management hierarchy can be found in the group except for when it comes to marketing and promotion issues, Sir Richard Branson would take a more involved role.

Therefore Sir Richard Branson adopted a ‘hands-off’ policy with his managers and by doing so, encouraged their own initiatives. By proving such freedom, managers would inevitably feel more of a sense of responsibility, ownership and would try their up most to make a success of it. Sir Richard Branson knew this fact. He was providing an enriching atmosphere in which managers would flourish just as he had done.

Its not surprising then, that management recruited carefully selected individuals to be innovative people, pioneers in their field, and to have the competitive streak in their personalities. It was also of importance for candidates to be able to share values and to work effectively as team players. It is the author’s opinion that Sir Richard Branson employed managers who were made up of his image; in terms of personal characteristics and persona.

The key emphasis was in innovation and differentiation. The aim was to offer more for less and that each company was truly a Virgin in its own field. Although to some this notion may seem a bit too good to be true, no one can deny that “the Virgin Group is one of the UK’s largest private companies” (with reference to the case study) with an annual turnover (estimated) at £3bn by the year 2000.

The Virgin Group’s rationale is to diversify into as many markets feasible, and extend the Virgin brand name further at a low cost; where stature could be relied upon to reduce barriers to entry into static markets. The Virgin Group sought a challenge in ever venture. They would aim to provide better quality products than any competitor in a complacent market. The key point is that the market to be entered must be still in its growing phase.

The alluring factor to Virgin’s Greenfield start-ups is the “reward-to-risk” ratio, which could be acted upon by the experienced and capable Virgin management team.

To establish the virginity of a venture, so to speak in an institutionalised market extensive research was conducted into the static market to derive whether some sort of niche can be achieved and thus satisfied. Sir Richard Branson and his team deployed their 5 point criteria, to which 4 out of the 5 must be met by a new venture before giving the final go ahead.

What my latest video on Youtube:

Pass Plus by Official DSA Instructor, Cost & Insurance

Strategic Relationships

All the business in the Virgin Group is strategically targeted towards a “five pillar” empire system that Sir Richard Branson is eager to create. At “the heart of Virgin’s core strategy to develop the five pillars of the business empire: travel, leisure, mobile phones, entertainment retailing and personal finance”. (Press Releases 30/01/02, http://www.virginmoney.com/newscentre/news2002_3.html)

As you can see displayed in Figure 1 (on page 1) all the ventures have inherited the Virgin name. What’s in a one might ask? There answer to that question is an exceptionally well marketed, promoted and trusted brand name. “Brand was the single most important asset of the company” (Case Study Page 4, Paragraph 1)

By giving a venture the prefix of Virgin; is to send out a message to the consumer to say out loud this new business is a “virgin” in its market place, “fun”, “innovative”, “daring”. It also has the effect of transferring all the marketing and promotional endeavours up to the present for that specific venture respectively.

As the author has previously mentioned the name Virgin has become synonymous with Sir Richard Branson’s name. The British public can immediately identify the roots to any Virgin advance as Sir Richard Branson’s very own. This is Sir Richard Branson’s key psychological strategy; and as you are acquainted by now, Sir Richard Branson plays a more interactive role into affairs of marketing and promotion; because aside from his indubitable genius marketing and promotion of the Virgin brand name is the Holy Grail to the expansion of the Virgin Empire. Thus many businesses outside the Virgin Group have shown their interest through joint ventures.

Examples of the power of the Virgin brand name can be concluded from the various joint ventures that have been formed. For example Virgin’s pledge in the Virgin Direct affair, was a mere £15m for the initial investment. But AMP Limited the leading international financial services initial investment was an extensive £450m; and yet it is a 50-50 joint venture!

All business within the Virgin Empire as mentioned in the Corporate Rationale section sacrificed short-term profits to gain long term growth and used an autonomous business level decision making method. Managers are free to make decisions independently for growth and feel the same degree of ownership and values that any other manager in the Virgin group would feel.

Businesses were ‘ring-fenced’ so that assets could not be switched between companies in the Virgin Group and if a company became too large another company would be spun off, in its place.

Value Adding

The Virgin Group, as a corporate parent does value to its business. It is achieved by the following points:

Understanding of institutionalised Markets

Virgin’s management team have done well in identifying complacency in the market. It is this expertise/experience coupled with the strategy to offer more for less that has help the Group plough through complacent business industries.

Virgin brand name to overcome barriers to entry

The Virgin brand name is a consumer’s champion and as mentioned previously is a much respected brand with the British public.

Limiting Risk in joint Ventures

Any company, corporation or organisation in a joint venture with the Virgin Group has the benefit of limiting its risk in the market place. This reiterates the point made in the last paragraph.

Management are not restricted

A flat management structure helps encourage innovation; provides flexibility and promotes the values of shared ownership and responsibility.

Innovation

Virgin’s senior staff consists of individuals with successful careers. The Group acquires like-minded partners in ventures who match their ability to innovate and differentiate.

These collective innovative thoughts and ideas are applied directly into business; which most often bare fruit. For example Virgin Mobile formulated partnerships with existing telecommunications operators to retail in mobile services. The Virgin management team successfully identified that the complacency was in the handling of network management. Their innovation led them to promote unique services that shock-up the market. These included “no line rentals”, “no monthly fees” and “cheaper prepaid” offers. Irrespective of the fact that Virgin Mobile did not actually operate it own network it had won the best wireless in the UK.

The Main Issues Facing the Virgin Group

Virgin Atlantic

The airline industry like many industries is cyclic. This proved to be dangerous by 2001, as Virgin seemed to rely entirely on the profits of Virgin Atlantic. Deregulation increased the competition in the market place. All in all most compositors were experiencing losses.

Virgin Rail

The biggest problem faced by the Virgin Group was the Strategic Rail Authority’s Review in 2000 because it was the most public. Virgin Rail was voted the most “unpopular” rail operator; and if that wasn’t enough the statistics: Virgin ranked 23 rd and 24 th out of 25 operators, was ample reason for Sir Richard Branson to feel a stake go through his reputation.

Slowly but surely Virgin’s prized brand name was being slowly chipped away by the press. The Virgin Group being such a large empire of 200 businesses was wonderful publicity when things were going right but all it took is for a hand full of businesses in the empire to either experience unavoidable consequences, which is the case of Virgin Atlantic and bad service and publicity as was the case with Virgin Rail for it to have quite disastrous effects on other areas of the group. Public confidence is such a delicate matter.

Recommendations

Become Less Diverse

Virgin should become less diverse. Its name has become diluted and its brand a purely endorsement brand. Lessons for the analysis of the environment must be learned. For example brand name alone isn’t enough. The pubic are sensitive and are attuned corporate strategies given time. Virgin as a corporate parent can add workable value to its businesses by investing and developing real expertise. Trying to limit risk is a knife that is sharp on both sides. On the one side it inevitably “limits risk”. On the other hand it sends out a contradictory signal to consumers. How can Virgin be “daring” when Sir Richard Branson’s value adding process is to limit risk? That is a question we should work towards eradicating.

Change in Strategy

The Virgin Group should change its policy to accommodate both independent and joint ventures to rely upon short-term profits on a few of its businesses for the sake of raises capital and release the ‘ring-fenced’ policy so that important revenue making Virgin Atlantic can be bailed out during the low times. Monies can be returned to the short-term ventures when the busy season arrives. The idea is to not restrict yourself to a policy of philosophy. Philosophies and policies should be such that can strategically change with time and environment.

Accounting Year End

Every effort should be made to bring in line the accounting year end date for all businesses in the Virgin Group to be on the same date. This shall aid towards providing a better picture of the health and wealth of the empire.

References

ANON., “Behind Branson” The Economist 21 February, 1998 pp.81-86

ANON., “The battered bride” The Economist 25 December, 1999

ANON., “Virgin to close its West End make-up store” Evening Standard 1 February, 2000

BFI UK Cinema admissions 1933-96

www.bfi.org.uk/faq/admissions.htm

BRANSON. R., “Branson replies: Letter to The Economist” The Economist 28 February, 1998.D.6

BRASIER, M. “Virgin in £200 million MGM spectacular.” Daily Telegraph 1 July 1995

RUCKINGHAM, L., “Branson raises the curtain on Virgin cinemas in £200 million deal with MGM” The Guardian 1 July, 1995

Press Releases 30/01/02, http://www.virginmoney.com/newscentre/news2002_3.html